This post was updated in July 2021.

If you’re reading this, you likely believe in the importance of a more perfect digital experience intelligence (DXI). For most organizations, however, better DXI requires new technologies, new systems, processes, and structures, and (often) a cultural transformation.

Becoming an experience-driven business is a long-term commitment that requires broad investments to support organizational change, process improvements, and advanced technology capabilities. — "The Business Impact of Investing in Experience" via Forrester & Adobe (2018)

So how do you get buy-in and resources for the changes you need to enact and the tools to make ‘em happen?

In the end, all roads lead to business impact.

The leaders in your organization are bombarded by countless requests daily. And every ask, every investment, every tool, every initiative is positioned as the most important thing. Executives will invest in what they believe will have the greatest impact in the long run. Of course, there are nuances like balancing short term and long term goals, and ease, effort, and overall cost. But impact is your most critical lever.

At Fullstory, we believe firmly that experience is—and will continue to be—the most important battleground for businesses. But this post isn’t about what we believe. This post is a tool for you.

In it, you’ll find 70 statistics from comprehensive reports that illustrate the business impact of providing a more perfect experience. They are organized according to pressing questions you’ll need to answer like:

Why is digital experience intelligence critical?

What is the cost of poor DXI? The calculable impact of better DXI?

What currently prevents us from improving the digital experience?

What are the considerations and challenges we need to consider?

Review the list, dig in, and utilize these resources to build your bulletproof business case to prioritize DXI.

Why is digital experience intelligence critical?

Because people spend a lot of time online ...

The number of Internet users, 4.57 billion, comprises about two-thirds of the global population (Mary Meeker)

28% of adults are online “almost constantly”, up 8 percentage points in the past 3 years ... (Mary Meeker)

... and digital media usage is accelerating: +8% vs. +7% from 2018 to 2019 (Pew)

As of July 2020, adults spend 6.6 hours per day with digital media: 3.5 hours on mobile, 2.4 hours via desktop or laptop, 0.7 hours on other connected devices ... (Mary Meeker)

... and daily time spent on mobile (209 minutes) surpassed TV (202 minutes) in 2020 (Hootsuite)

... and they buy online.

59% of everyday transactions are made via digital payment (Mary Meeker)

At current growth levels online spending for 2020 is set to exceed online spend for all of 2019 by October 5th. (Adobe)

Research shows that COVID-19 has only amplified the importance of the digital experience intelligence:

69% of digital experience professionals report that the digital customer experience has become more important to their customers because of COVID-19 (Fullstory)

65% of digital experience professionals report that the digital customer experience has become more important to their organization because of COVID-19 (Fullstory)

70% of people report spending more time with mobile decides due to COVID-19, while 47% of people report spending more time on a laptop (Hootsuite)

Because of the nature of this crisis, uncertainty is likely to be the status quo for the foreseeable future. Which means that your organization’s ability to shift seamlessly and continually deliver value to customers is critical to thrive in the new normal.

Digital experience matters more as COVID-19 clears

In 2021, Fullstory surveyed 1,500 North American consumers to find out what digital issues they find most frustrating when transacting online.

A sampling of what we found:

8 in 10 (81%) of shoppers plan to increase or maintain their online usage, even when in-person activities resume after COVID-19.

What makes a “good” digital experience in the eyes of consumers? According to the survey, 83% of respondents say that the most important factor is simply being able to “quickly accomplish what I came to do.”

64% of respondents have been frustrated or struggled with an online transaction in the last six months.

Seventy-seven percent of consumers (3 out of 4) reported that they will leave without completing a transaction if they encounter an error

65% say they trust a business less when they experience a problem using a website or mobile app, ultimately splintering customer relationships and loyalty.

Only 12% say they are very likely to provide feedback to the business when they have a problem.

Want to take your digital experience to the next level? Let’s chat.

Request your personalized demo of the Fullstory Digital Experience Intelligence platform.

What is the cost of poor DXI? What is the calculable impact of better DXI?

People prefer digital channels ...

55% of customers prefer digital channels over traditional channels (68% of Millennials / Gen Z)

40% of customers won’t do business with a company if they can’t use their preferred channels

... and a seamless experience is critical.

84% of customers say the experience a company provides is as important as its products or services

73% of customers say one extraordinary experience raises their expectations of other companies

66% of customers are willing to pay more for a great experience

64% of customers expect tailored engagement based on past interactions …

... but the average enterprise uses 900 different applications, only 29% of which are integrated

74% of customers expect companies to use existing technologies in new ways to create better experiences

75% of customers expect companies to use new technologies to create better experiences

53% of customers want more connection between their devices

Source: State of the Connected Customer (Third Edition) – Salesforce

Publish year: 2019

Relevance to digital experience: For three years running, Salesforce has published its “State of the Connected Customer” report based thousands of survey responses from consumers and business-to-business buyers. The survey and report seek to paint a picture of the common, modern customer journey—digital is a massive part of this journey across industries, products, and services and many of the statistics included highlight the importance of the digital experience.

Methodology: Data in this report is from a double-blind survey conducted April 2 to 18, 2019, that generated responses from 8,022 consumers and business buyers in Australia / New Zealand, Canada, France, Germany, Hong Kong, India, Italy, Japan, Singapore, Spain, Switzerland, Thailand, the United Kingdom/ Ireland, and the United States. All respondents are third-party panelists (not limited to Salesforce customers).

Get the complete report via Salesforce.com.

There is a correlation between customer experience and loyalty:

94% of consumers who give a company a “very good” CX rating are “very likely” to purchase more products or services from that company in the future …

… Only 18% of those who gave a company a “very poor” CX rating say the same

95% of consumers who give a company a “very good” CX rating are “very likely” to recommend the company …

… Only 15% of those who gave a company a “very poor” CX rating say the same

75% of consumers who give a company a “very good” CX rating are “very likely” to forgive a company for a bad experience …

… Only 14% of those who gave a company a “very poor” CX rating say the same

90% of consumers who give a company a “very good” CX rating are “very likely” to trust a company to take care of their needs …

… Only 15% of those who gave a company a “very poor” CX rating say the same

Source: The ROI of Customer Experience – Qualtrics XM Institute (Formerly Temkin Group)

Publish year: 2019

Relevance to digital experience: In 2018 Qualtrics—a leading experience management platform—acquired customer experience thought leader, Tempkin Group, and formed the Qualtrics XM Institute. The Institute, led by Bruce Tempkin, publishes comprehensive research on all things “experience management” with digital experience being a primary focus.

Methodology: Researchers surveyed 10,000 U.S. consumers about their experiences with and loyalty to 294 companies across 20 industries. Each of these 294 companies had already received a Customer Ratings score based on three areas of customer experience: Success, Effort, and Emotion. Researchers then compared survey data with these Customer Ratings.

Get the complete report via Qualtrics XM Institute.

Additional stats about the impact of digital experience:

1 in 3 consumers will walk away from a brand they love after just one bad experience

54% of U.S. consumers say customer experience at most companies needs improvement

65% of U.S. customers find a positive experience with a brand to be more influential than great advertising

Consumers want the design of websites and mobile apps to be elegant and user-friendly; they want automation to ease experience. But these advances are not meaningful if speed, convenience and the right information at the right time are lacking. — "Experience is everything: Here's how to get it right" via PwC (2018)

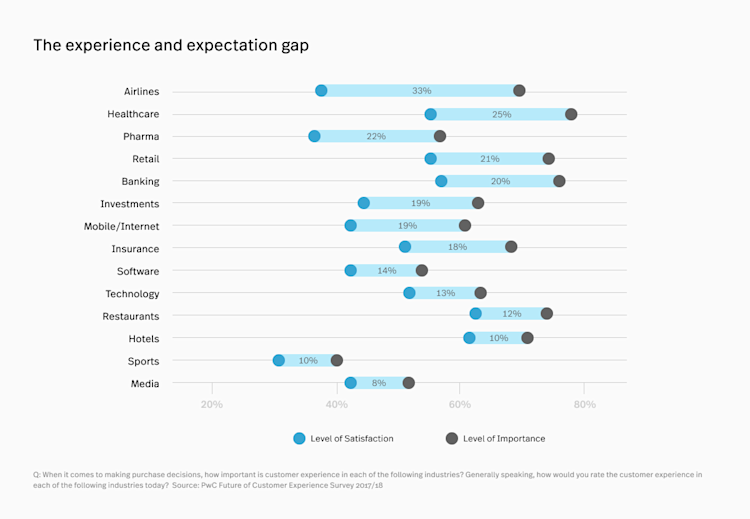

Noteworthy: The experience and expectation gap across industries.

In this report, PwC highlights the experience and expectation gap across industries. Respondents were asked: When it comes to purchase decisions, how important is customer experience in each of the following industries? Generally speaking, how would you rate the customer experience in each of the following industries today?

Source: Experience is everything: Here’s how to get it right – PwC

Publish year: 2018

Relevance to digital experience: The marketing technology landscape currently includes over 7,000 tools. With so much choice and so many technological advances, it is very easy to get caught up chasing the ‘shiny new thing’. But PwC’s 2018 report highlights the importance of getting the basics right when it comes to your digital experience—and the cost of not checking these boxes.

Methodology: PwC surveyed a representative sample of 15,000 people from 12 countries via an online survey and in-field interviews; 4,000 respondents were from the U.S., the remaining 11,000 were from a sampling of countries around the globe.

Get the complete report via PwC.

What (often) prevents organizations from improving the digital experience?

Organizations say experience is important ...

9 out of 10 organizations see customer experience (CX) as a competitive differentiator

... but few have the organizational structures in place to succeed.

Only 30% of organizations have an executive on the board who is accountable for customer experience

Almost 1 in 5 organizations are operating without a formal CX strategy and over half say overall accountability and ownership for CX is unclear

33% of organizations continue to manage their CX solutions in individual business units ...

... and only 33% say separate business units collaborate to design a common CX across interaction types and touchpoint

Only 13.5% of organizations say their current analytics capability is optimized, despite “analytics” being named the top factor to reshape CX

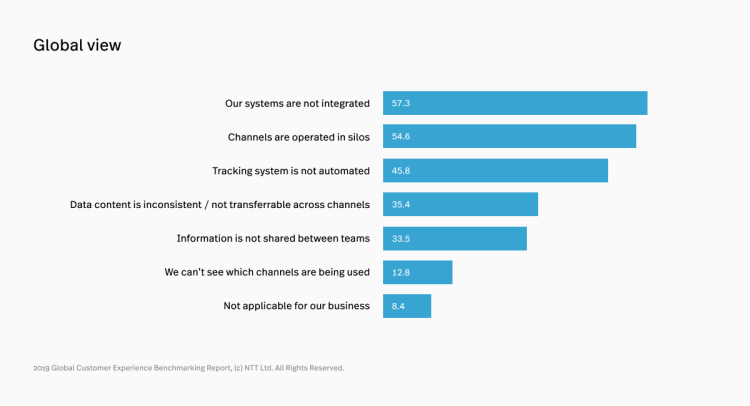

At this point, most organisations are still evaluating and building their data analytics capabilities. They’re collecting more data than ever, from a widening range of channels, and that’s part of the problem. Too much data from different sources configured in different formats and managed by individual business units makes it difficult to track customer journeys across channels and get a single view of the customer. — "2019 Global Customer Experience Benchmarking Report" via Dimension Data

Source: 2019 Global Customer Experience Benchmarking Report – Dimension Data

Publish year: 2019

Relevance to digital experience: Better customer experience and digitization are intertwined. Seventy-nine percent of respondents in this research say that the number one factor driving their digital business transformation is “to improve customer experiences”. The second most important factor? “Customer demand for digital”. CX is DX.

Methodology: Research data for this report was gathered via online questionnaire from mid-April 2018 to July 2018. Findings for the 2019 report are comprised of responses from 1,114 participants drawn from 59 countries and balanced across the Americas, Asia Pacific, Australia and New Zealand, Middle East and Africa, and Europe. The sample spans 13 industry sectors. Research is based on a probability sample of strictly random participants involved in the provision of customer experience services.

Get the executive report via Dimension Data.

Browse all benchmarking data via the 2019 Results Portal.

Additional statistics from Fullstory's 2020 State of Digital Experience report:

57% of organizations say that their main challenge in properly tracking customer journeys is a lack of system integration ... (Fullstory)

... and organizations that report delivering an ideal digital experience are 223% more likely to report having a very integrated technology stack than their less successful counterparts. (Fullstory)

Organizations that are less successful at delivering an ideal digital experience are 33% more likely to report that they struggle to create consensus among leaders about top digital experience priorities. (Fullstory)

What considerations and challenges should organizations consider when it comes to digital experience?

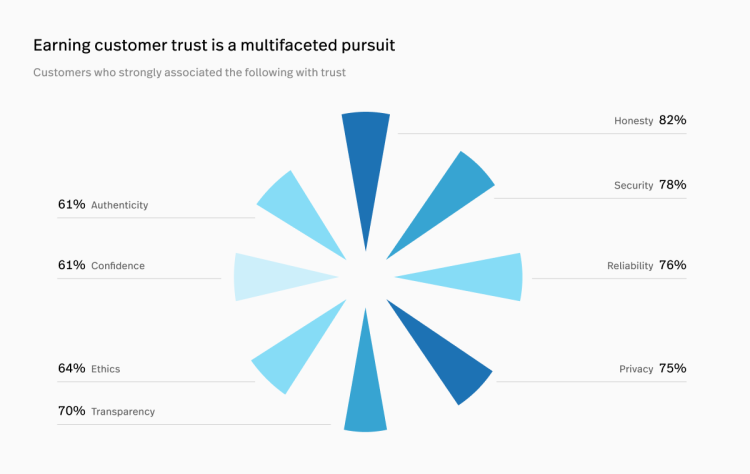

Data is critical to improve DX. Consumers are willing to part with their data if ...

63% of consumers say they’d share more information with a company that offers a great experience (PwC)

88% of U.S. consumers say that how much they trust a company determines how much they’re willing to share personal information (PwC)

63% of U.S. consumers say they’d be more open to sharing their data for a service they truly value (PwC)

78% of customers are more loyal to companies that are transparent about how their data is used (Salesforce)

However ...

63% of customers say most companies aren’t transparent about how their data is used (Salesforce)

54% of customers say most companies don’t use their data in a way that benefits them (Salesforce)

46% of customers feel they’ve lost control over their own data (Salesforce)

41% of customers don’t believe companies care about the security of their data (Salesforce)

84% of customers are more loyal to companies that have strong security controls (Salesforce)

Trust is a critical component:

73% of customers say trust in companies matters more than it did a year ago …

… but 54% say it's harder than ever for a company to earn their trust (Salesforce)

89% of customers are more loyal to companies they trust and 65% have stopped buying from companies that did something they consider distrustful (Salesforce)

Deal breakers and buying decision factors:

The following statistics are all from the Edelman report cited below.

85% of consumers say whether a brand “consistently offers the best quality within the category” is a deal breaker or deciding factor in their buying decision

84% of consumers say whether a brand “is very convenient and very easy to use” is a deal breaker or deciding factor in their buying decision

84% of consumers say whether a brand “consistently offers the best value for the money within the category” is a deal breaker or deciding factor in their buying decision

82% of consumers say whether a brand “uses only high-quality ingredients, components or customer service tools” is a deal breaker or deciding factor in their buying decision

81% of consumers say that their ability to trust a brand “to do what is right” is a deal breaker or deciding factor in their buying decision

53% of consumers will buy first from a brand they have trusted for a long time...

… and only 25% from a brand they do not fully trust

62% of consumers will stay loyal to a brand they have trusted for a long time...

… and only 29% from a brand they do not fully trust

69% of consumers have growing concerns about brands’ impact on society

56% of consumers say brands us societal issues as a marketing ploy to sell more of their product

Source: 2019 Edelman Trust Barometer – Edelman

Publish year: 2019

Relevance to digital experience: Edelman is the largest public relations firm in the world, giving them expansive reach and access to consumers across the globe. They have conducted the “Trust Barometer” report annually for 20 years. While the 2020 report looks at trust across institutions (government, business, NGOs, media), the 2019 report focused on the importance of consumer trust of brands and brand communication across channels, digital included—that is the data presented here.

Methodology: Edelman conducted three separate surveys of consumers for this report across eight markets: Brazil, China, France, Germany, India, Japan, the U.K. and the U.S. The first, an online survey with 16,000 respondents (2,000 per market), was conducted April to May 2019. The second with 8,000 respondents (1,000 per market), was conducted April 2019 via mobile. The third with 1,500 respondents (500 per market), was conducted April to May 2019. Data is nationally representative based on age, region, and gender.

Get the full report via Edelman.