The behavioral data and analytics platform

The data you need to win customers for life

From understanding customers to optimizing workflows, Fullstory provides the insights you need to deliver personalized experiences and achieve impactful outcomes.

Capture. Understand. Act.

Capture everything, miss nothing

Automatically collect every interaction across platforms

Eliminate manual tagging and guesswork

Start with complete, trustworthy behavioral data from day one

Get instant AI-powered insights

Turn behavioral data into clear, reliable answers

Understand the why behind user actions, not just the what

Focus on decisions, not dashboards, with AI agents

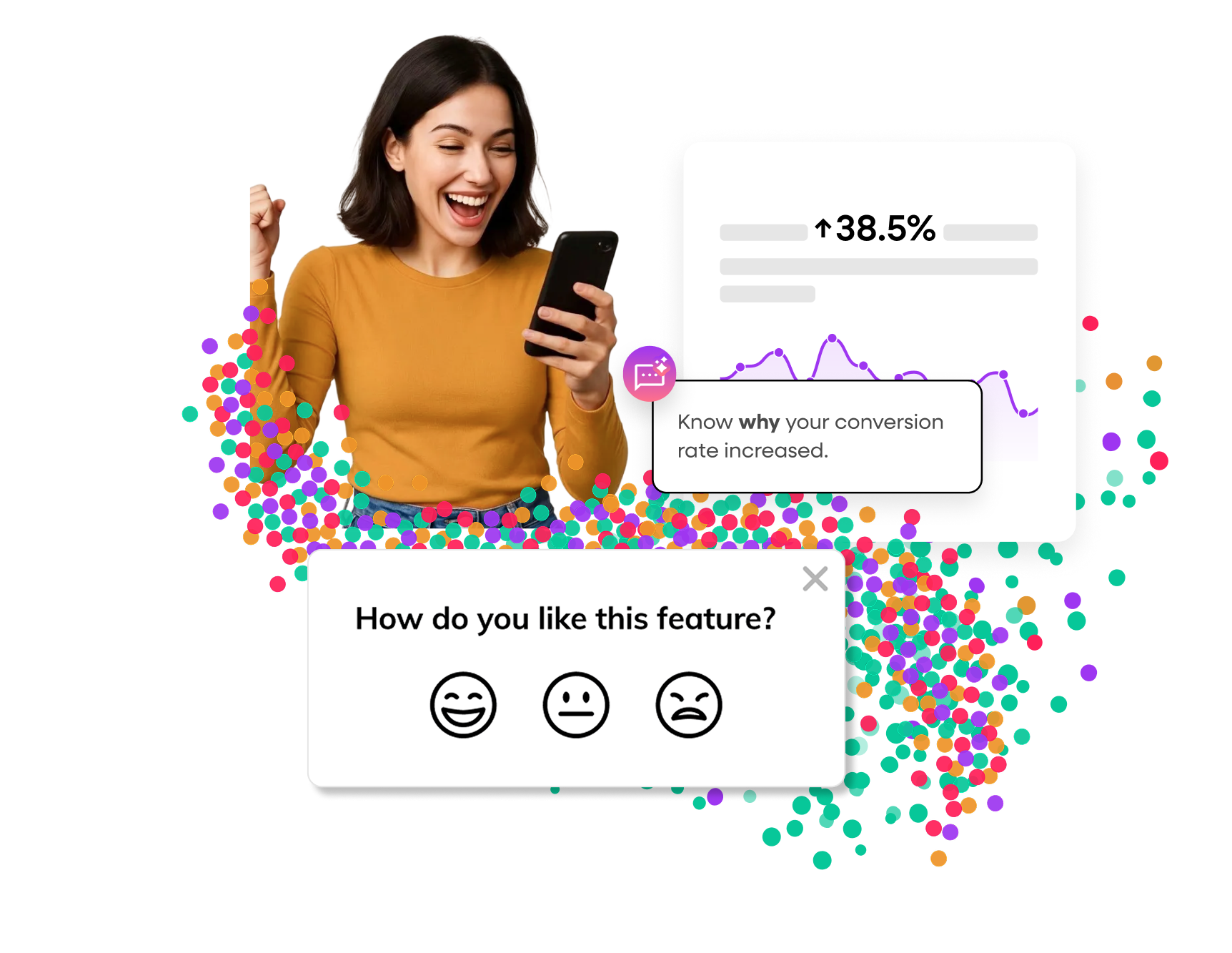

Turn insights into in-product action

Guide users and collect feedback directly in the experience

Reach users at key moments across their journey

Measure guide performance and survey responses within Analytics

Drive measurable results across the entire customer journey

Faster resolution

Go from bug report to root cause in minutes.

Reduced friction

Identify and eliminate points where users struggle.

Increased conversions

See exactly where and why users drop off in funnels.

Improved retention

Improve digital experiences based on real behavior.

Activate behavioral data at scale

Unlock deeper customer insights

Fullstory Analytics surfaces behaviors across mobile and web experiences to reduce friction, drive conversions, and keep customers coming back.

✦ Optimize customer journeys

✦ Identify and resolve experience issues

✦ Unify user journeys across devices

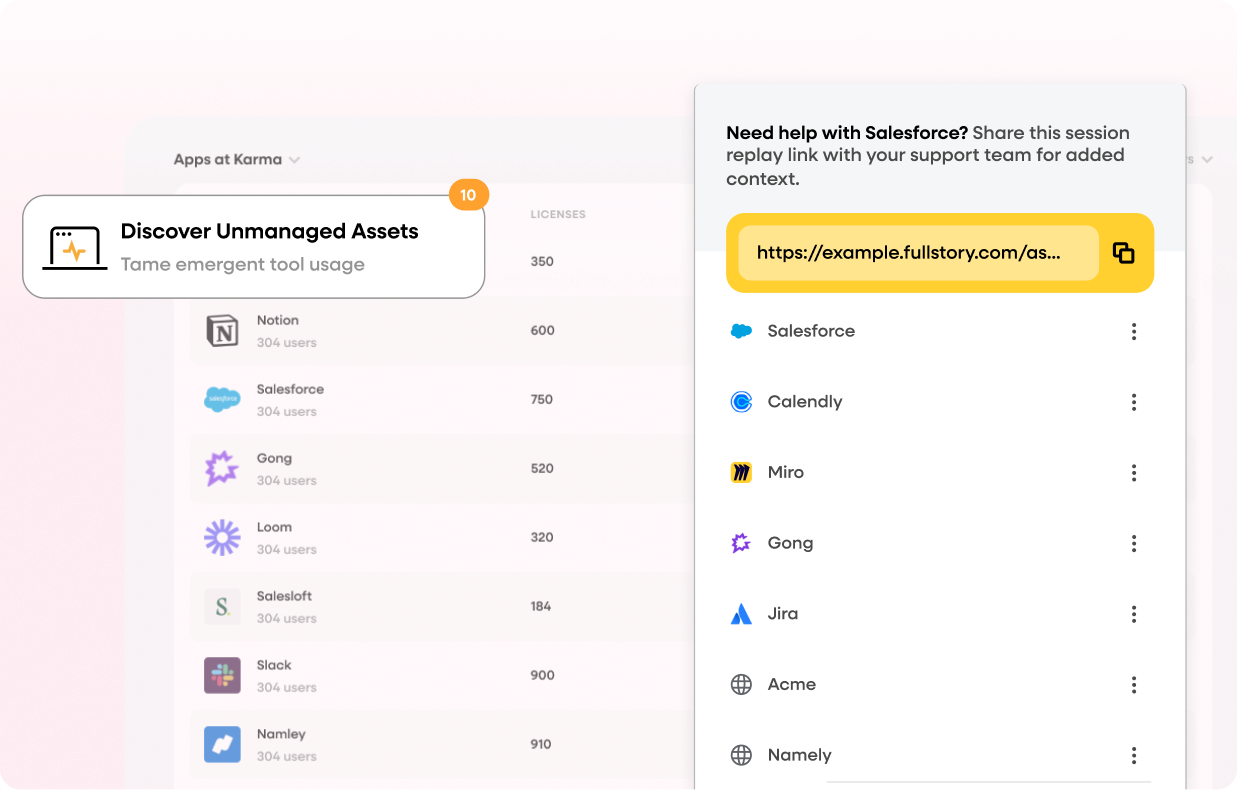

Improve employee experience

Fullstory Workforce helps you optimize internal tools and reduce workflow friction for better employee experiences.

✦ Improve employee workflows

✦ Streamline IT support and troubleshooting

Integrate behavioral data into your existing systems

Fullstory Anywhere activates real behavioral data across your tech stack, enabling smarter decisions and more personalized customer experiences.

✦ Analyze data and integrate with your existing stack

✦ Create personalized experiences in real-time

Solve your most complex challenges with precision

Understand customer behavior

Gain insights into customer actions, uncover friction points, and personalize experiences with Fullstory’s behavioral data.

Improve digital experiences

Identify and fix pain points in real time, creating seamless, engaging experiences that keep customers coming back.

Drive intelligent automation

Use real-time behavioral data and AI to automate personalized content and offers, boosting engagement effortlessly.

Accelerate data-driven decisions

Make smarter, faster decisions with clear, actionable insights from Fullstory’s behavioral data and AI-driven recommendations.

Additional resources

Discover the leading enterprise behavior analytics tools built for scale, precision, and actionable behavioral data—one of which is a clear standout.

Fullstory Anywhere: Activation empowers technical solution owners to deliver personalized digital experiences by acting on real-time user behavior.

AI isn’t just an add-on—it’s the future of behavioral data. See how Fullstory’s StoryAI delivers real insights, not just reports.

Behavioral data that means business.

Turn behavioral insights into action with Fullstory Analytics. Identify friction, optimize experiences, and empower teams to make smarter, real-time decisions that drive impact.