Fullstory’s Maggie Moore recaps Google Next 2025 with standout moments, smart takes on AI trends, and the real signal beneath the hype.

Survey reveals why AI stalls for engineering & IT teams: messy data, low confidence, and tool overload.

Survey insights reveal what’s holding product teams back from using AI and behavioral data to drive innovation and user experience improvements.

AI isn’t just an add-on—it’s the future of behavioral data. See how Fullstory’s StoryAI delivers real insights, not just reports.

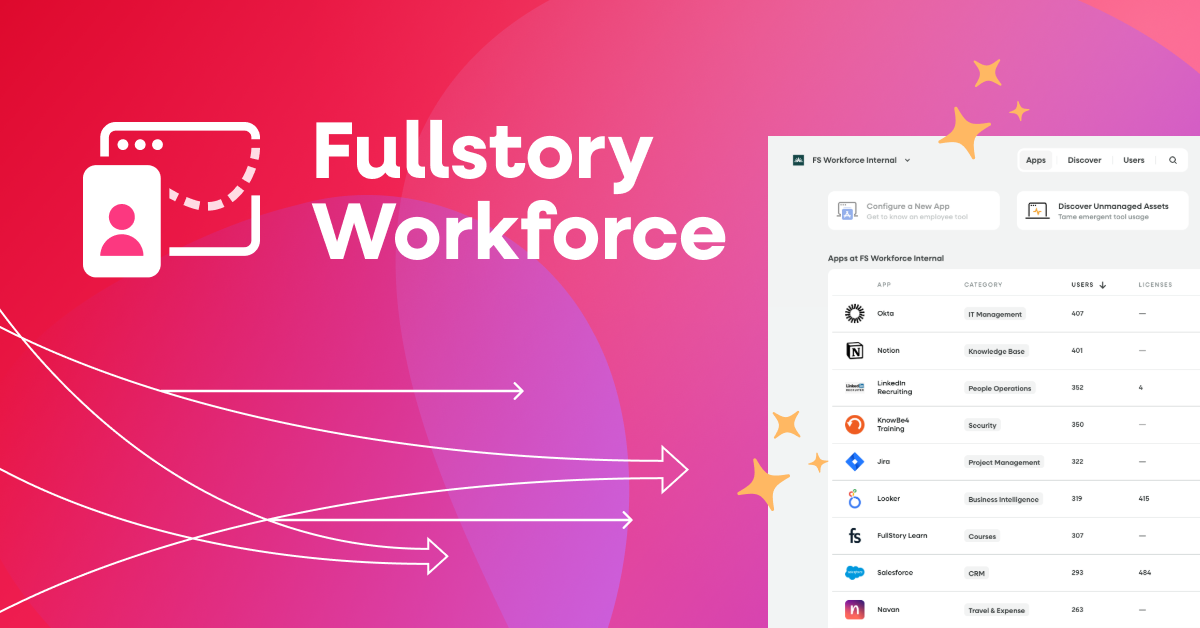

Optimize employee workflows with Fullstory Workforce—eliminate friction, speed up IT fixes, and cut software waste to boost efficiencies.

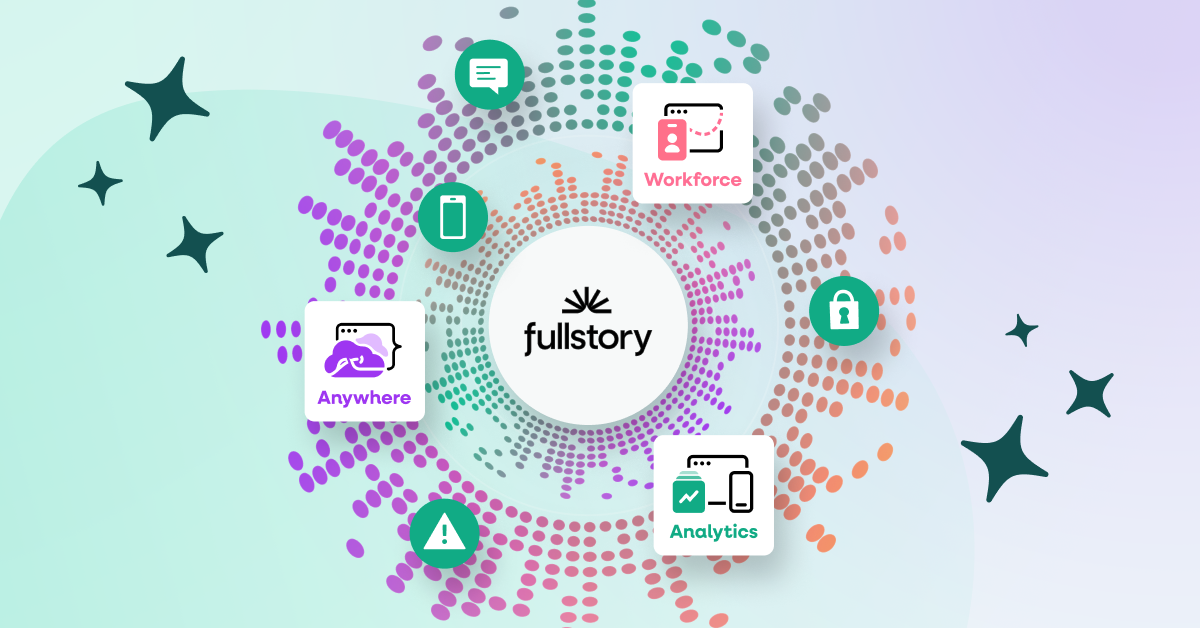

Unlock the full power of your data with Fullstory Anywhere—advanced analytics and real-time personalization, built for action, not just insights.

Fullstory expands its portfolio with new AI-driven solutions, helping teams collect, analyze, and act on behavioral data faster and more effectively.

AI-powered co-shopping with Fullstory and Quantiphi uses real-time behavioral data to personalize shopping and guide customers with a smart chatbot.

Most businesses struggle to act on AI, data, and UX. Learn what’s holding them back—and how to lead with confidence.