Key takeaways in this article:

Product analytics captures real user behavior inside web and mobile products through event-based tracking, enabling data-driven decisions across acquisition, activation, retention, and revenue.

Modern product analytics platforms like Fullstory combine deep behavioral data, session replay, and AI to reveal not just what users do, but why they do it, without relying solely on guesswork or surveys.

Product analytics benefits teams across the entire organization: product managers prioritize roadmaps, UX designers reduce friction, engineers reproduce bugs, marketers optimize campaigns, and leadership proves ROI.

High-impact use cases include cohort analysis, churn and retention analysis, funnel analysis, milestone tracking, and personalization based on actual user interactions.

Products make the world go ’round. But the teams building them usually don’t struggle with ideas—they struggle with uncertainty.

Did users abandon onboarding because the value wasn’t clear, or because the page broke on one browser version? Is checkout conversion down because pricing changed, or because one shipping option is confusing? Product analytics exists to answer questions like these with behavioral data, not vibes.

This guide breaks down what product analytics is, why it matters, which teams use it, and how to build a workflow that actually gets used (not one that dies as a dashboard nobody opens).

What is product analytics?

Product analytics is the practice of collecting, analyzing, and interpreting behavioral data from digital products, websites, mobile apps, and other interfaces, to understand how people actually use what you’ve built. Unlike user surveys or customer interviews that capture opinions, product analytics captures facts: every click, tap, scroll, and error that occurs inside your product.

That sounds simple. The nuance is what makes it useful:

Surveys and interviews tell you what people say they experienced.

Product analytics shows what actually happened—step by step.

Most product analytics starts with events. A user clicks a button, submits a form, completes onboarding, hits an error—each action becomes an event with a timestamp and properties (device, plan, location, page/screen, and more).

Example: an event might be “Started checkout” on 2025-01-10 at 14:32, with properties like device type (iOS), plan (Premium), and region (North America). When you connect events into sequences, you can see the journeys that lead to success—and the ones that quietly fall apart.

Why is product analytics important?

Product analytics matters because teams ship changes all the time, but many teams can’t answer a basic question afterward:

Did that change help users—or just move numbers around?

Good product analytics reduces wasted work in three common ways:

It turns “we think” into “we know.” You can point to the exact step where users hesitate or abandon.

It makes bugs solvable. Technical issues stop being rumors (“it’s broken for me”) and become reproducible evidence with scope and impact.

It helps teams prioritize. You can focus on the friction that affects meaningful cohorts (high-value plans, key regions, specific devices, and important flows).

Fullstory’s Private by Default approach evaluates and redacts sensitive information directly on-device, enabling teams to gain deep insight without exposing user data.

How do modern product analytics platforms work?

How do modern product analytics platforms work?

Modern product analytics platforms are designed to get teams from setup to insight quickly, without heavy instrumentation or long ramp-up periods. While implementations vary, most follow the same core flow.

Deploy lightweight capture: Teams install a lightweight SDK or code snippet across web and mobile apps. Data collection begins almost immediately, often within hours or days, not weeks of planning and manual event setup.

Automatically capture behavioral context: User interactions are recorded along with the context that explains them: clicks, taps, navigation paths, errors, device details, and performance conditions. Strong platforms reduce privacy risk by evaluating and redacting sensitive data on-device before it ever leaves the user’s environment.

Index data for flexible, retroactive analysis: Behavioral data streams to secure infrastructure, where it’s indexed and made available across dashboards, funnels, cohorts, and session replay. Teams can ask new questions of historical data without waiting for fresh tracking to be added or new events to accumulate.

Use AI to reduce manual digging: AI layers help teams focus faster. Instead of scanning charts and filters, tools like Fullstory’s StoryAI can answer plain-language questions, summarize complex sessions, and highlight likely drivers behind conversion drops, error spikes, or friction trends.

Protect trust with “Private by Default” practices: Privacy and security are built into the workflow. Field-level masking, role-based access controls, governance tools, and on-device evaluation ensure teams get actionable behavioral insight without exposing sensitive user data or compromising compliance.

Together, these pieces create a system where teams can observe real user behavior, investigate issues in context, and move from insight to action—without slowing down development or putting user trust at risk.

What teams use product analytics?

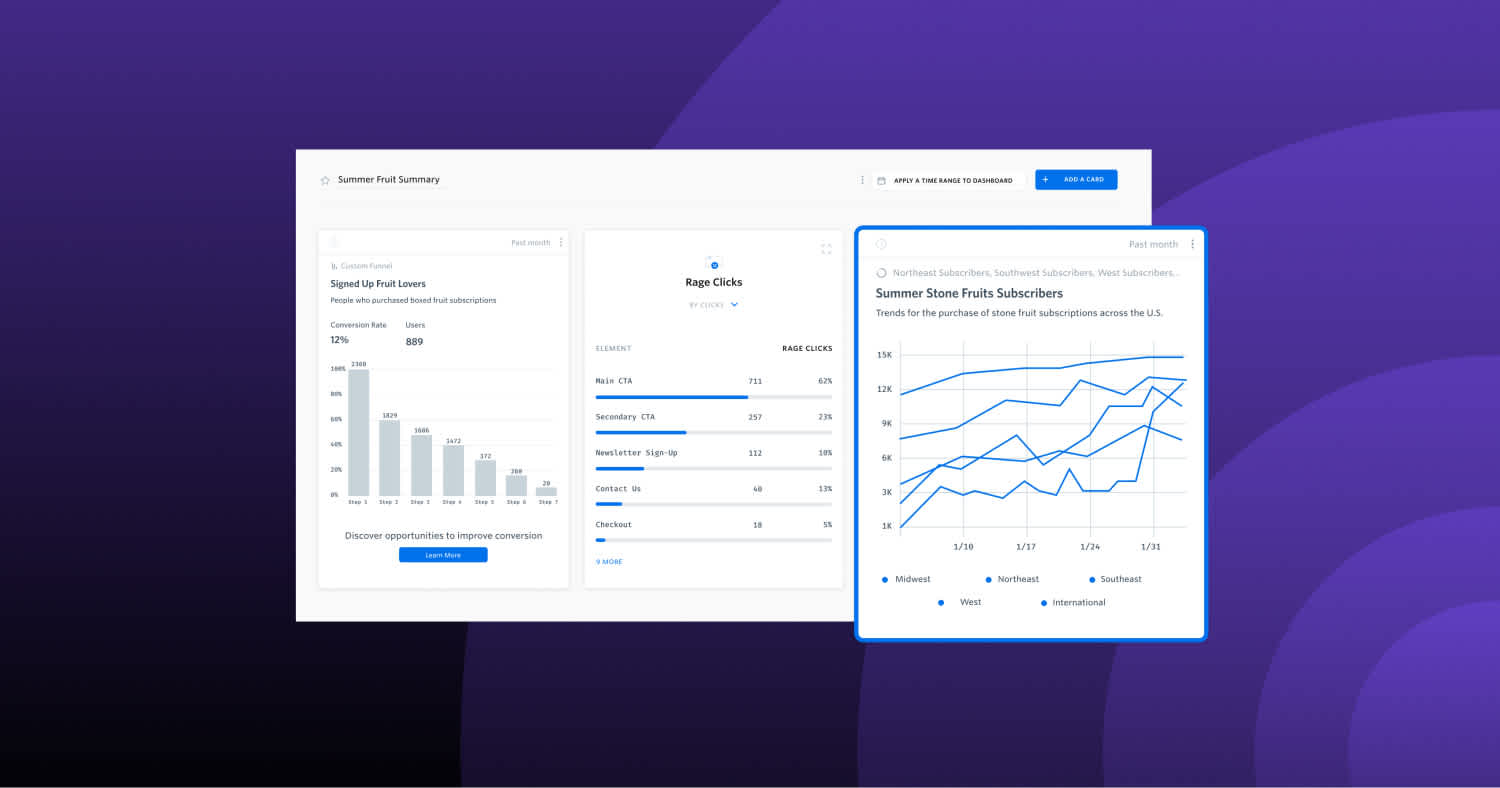

Product analytics isn’t only for product managers anymore. The best teams treat it like shared infrastructure: one behavioral dataset, many ways to use it:

Product managers use product analytics data to evaluate feature launches, identify underused capabilities, and prioritize the roadmap by actual impact. For example, after rolling out a new subscription page, a PM can track how many users reach it, complete the flow, and convert, then compare that cohort’s retention against previous signup methods.

UX and design teams watch replays and review funnels to refine navigation, forms, and user flows based on real friction signals. Rather than guessing that a dropdown menu is confusing, designers can see users clicking the wrong options repeatedly, then redesign with confidence.

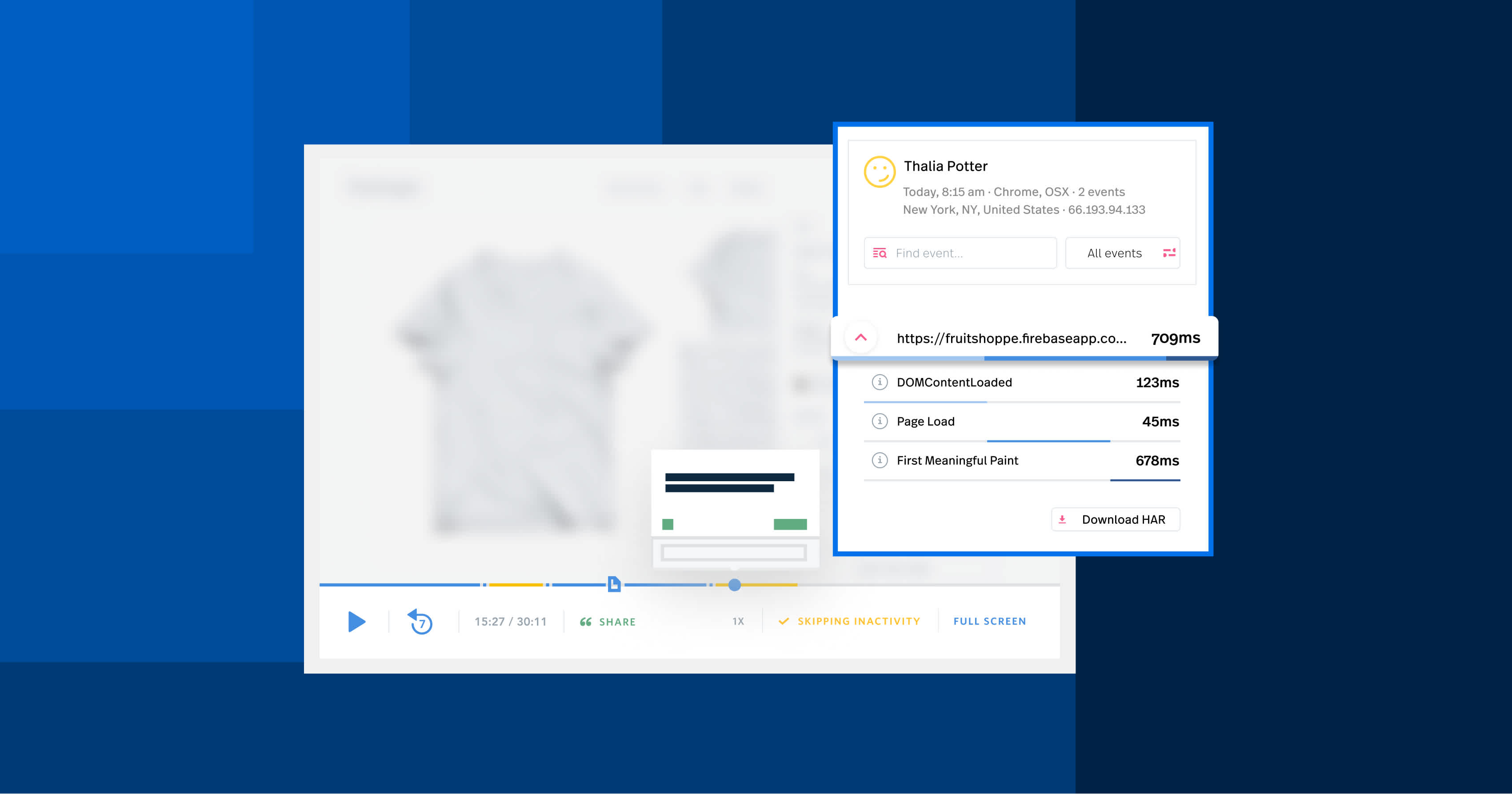

Engineering and QA teams reproduce bugs via session replay, correlate errors with impacted revenue, and validate that fixes actually reduce friction. When a customer reports “the button didn’t work,” engineers can pull up the exact session, see the error in context, and identify whether it affected hundreds of other users.

Marketing and growth teams build cohorts of high value customers, analyze how different acquisition channels translate into in-product behavior, and tune activation journeys. Seeing that users from a particular campaign churn faster, or slower, than average guides marketing spend decisions.

Customer support and CX teams investigate specific tickets by reviewing associated sessions, spot repeated frustration patterns, and proactively flag issues for product teams. Instead of asking customers to describe what happened, agents see exactly what the user experienced.

Data and analytics teams monitor high-level key metrics like conversion, user retention, and NPS drivers. They align teams around shared data, ensuring everyone works from the same understanding of what’s happening inside the product.

What data does product analytics track?

Most product analytics programs start with events—but strong programs don’t stop there.

An event is a recorded moment in time: a user clicks a button, submits a form, encounters an error, or abandons a flow. Each action is captured with a timestamp and contextual properties. On their own, events are just points on a timeline. When enriched with the right signals, they become a clear picture of how real people experience your product.

Modern product analytics platforms capture multiple layers of data around every interaction, so teams can move from “something happened” to “here’s what broke, for whom, and why.”

User interactions: Clicks, taps, swipes, scrolls, text inputs, page views, and screen transitions form the backbone of behavioral analysis. These interactions show how users progress through key flows, where they hesitate, and where they loop or drop entirely.

Navigation and journey paths: Beyond individual actions, platforms track how users move between screens, features, and sections over time. This reveals unexpected paths, backtracking behavior, and points where users get lost or take longer-than-expected routes.

Form and input behavior: Field focus, time-to-complete, validation errors, field abandonment, and re-typing patterns expose friction that conversion metrics alone can’t explain. A form may “convert,” but analytics can show whether users struggled the entire way through.

Technical and performance context: Device type, OS version, browser, app version, screen size, network conditions, load times, and JavaScript or native errors help teams pinpoint issues that only affect certain environments. This is often where “we can’t reproduce it” bugs finally become solvable.

Business and account context: Properties like plan tier, account size, region, role, subscription status, and lifecycle stage (trial, active, churned) connect behavior to outcomes. This layer makes segmentation meaningful and allows teams to prioritize fixes that impact high-value customers first.

Experience and frustration signals: Repeated clicks, dead clicks, rage clicks, long idle periods, failed searches, and error encounters act as early warning signs. These moments often never generate support tickets, but they’re where users quietly decide whether to continue or give up.

Timing and sequencing data: How long users pause between steps, how quickly they complete key actions, and the order in which behaviors occur all matter. Timing reveals hesitation, confusion, and cognitive load that raw conversion rates can’t capture.

Cross-device and cross-session behavior: Modern users don’t experience products in a single sitting or on a single device. Product analytics can connect behavior across sessions and platforms, showing how research on mobile leads to completion on desktop, or where friction on one device impacts outcomes later.

Custom, domain-specific events: Teams define events that reflect real business value, such as “Generated quarterly compliance report,” “Submitted insurance claim,” or “Published first listing.” These events align analytics with outcomes that actually matter, not just clicks.

Fullstory’s Fullcapture approach automatically logs rich interaction data and reconstructs sessions without storing actual video. This enhances both searchability (teams can query across all the events for user retention metrics) and privacy (no raw screenshots to expose sensitive information).

Core examples and use cases of product analytics

This section covers the analytical approaches that product teams rely on daily: cohort analysis, churn and retention analysis, funnel analysis, milestone tracking, customer journey analysis, and personalization. Each method answers different questions, but all draw from the same foundation of event-based behavioral data.

Cohort analysis

Cohorts are groups of users who share a characteristic or behavior. You might define a cohort like “Users who completed onboarding in October” or “Customers on Enterprise plan in North America” or “Users acquired through paid search in Q1.” Comparing cohorts over time reveals patterns that aggregate metrics hide.

Cohort analysis lets you track retention curves, feature adoption, expansion revenue, and support ticket volume for different groups. For example, comparing users who signed up before and after a product change shows whether the change actually improved outcomes. Comparing acquisition channels reveals which sources bring users who stick around versus those who churn quickly.

Example: A B2B SaaS team discovers that users who view at least three product tutorials within their first 7 days have 40% higher 90-day retention. Armed with this insight, they use product analytics to identify users who haven’t hit that milestone, then trigger in app guidance nudging them toward tutorials. The result is more new users reaching the high-retention cohort.

Churn and retention analysis

Churn refers to users or accounts that stop using or stop paying for your product. Retention is the inverse, those who keep coming back. Understanding both requires tracking typical windows: Day 1, Day 7, Day 30, and for subscription products, 6- or 12-month retention.

The power of product analytics for churn analysis comes from combining quantitative data (who left and when) with qualitative context from session replay and frustration signals. You can see that 200 accounts churned in March, then drill into sessions from those users to identify common friction points: slow-loading reports, confusing navigation, or repeated errors.

Example: A B2B SaaS app that finds customers churning within 60 days often encounter the same slow-loading analytics report. Using a product analytics tool, the team quantifies how many users hit this issue, correlates it with churn risk, reproduces the problem in session replay, and validates after fixes ship that the friction, and the churn, decreased.

Funnel and conversion analysis

Funnels represent ordered steps users take toward a goal. A typical funnel might be:

“Visited pricing → Started trial → Completed profile → Used core feature 3 times → Upgraded to paid.”

Conversion analysis examines how many users progress between each step and where drop-offs occur.

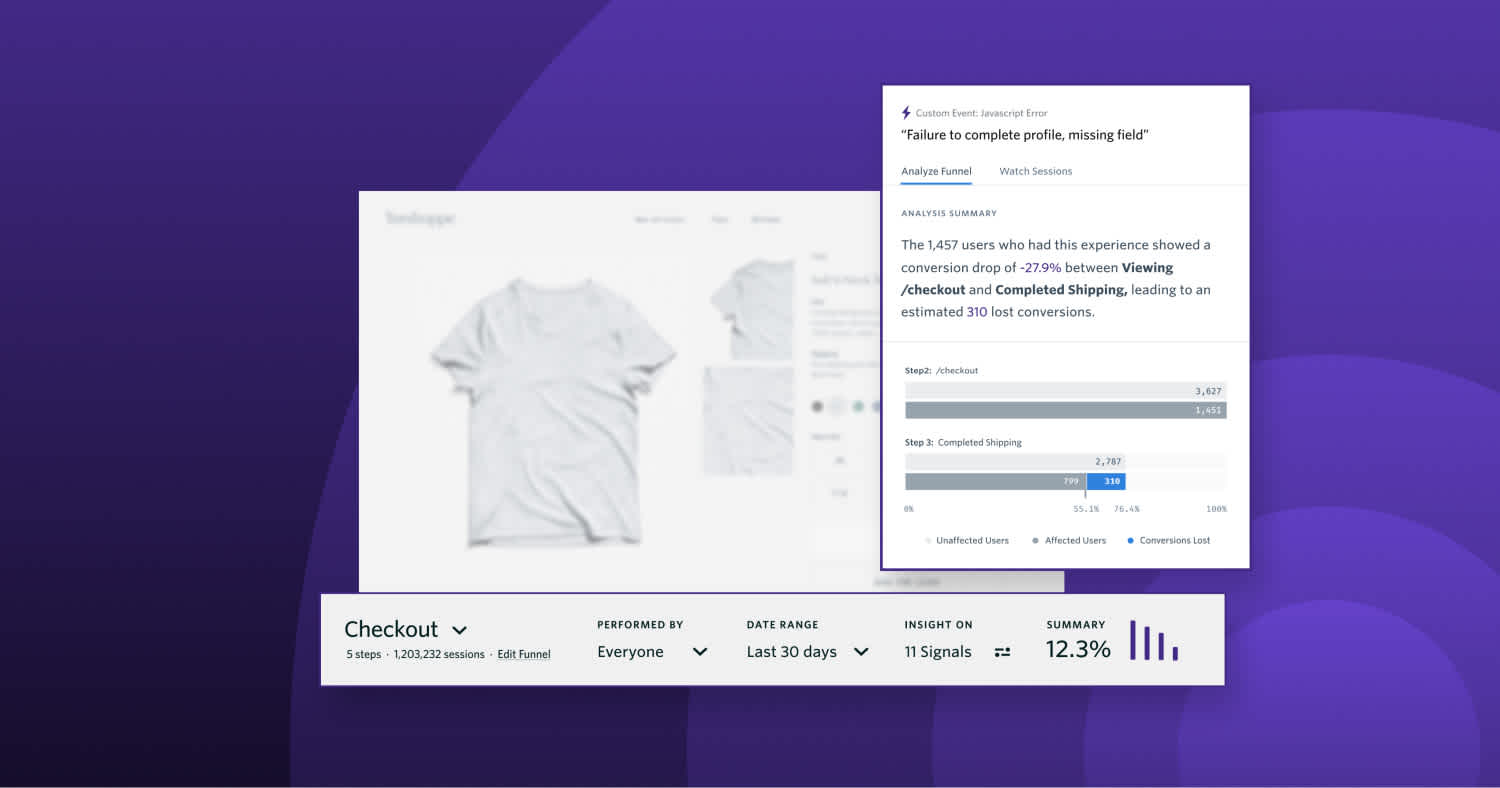

Product analytics platforms allow teams to build funnels retroactively over automatically captured events. You don’t have to define the funnel before gathering data, you can ask the question later and still get answers from historical data. When you spot a drop-off, you can jump directly into session replay to see what happened at that step.

Example: An ecommerce team preparing for the Q4 holiday season might analyze their checkout funnel and discover a 45% drop-off between “added to cart” and “completed payment.” Reviewing sessions reveals that users are confused by shipping options. Simplifying that screen, based on what analytics data showed, increases completion rates and recovers revenue.

For a mobile subscription app, funnel analysis might show that users stall at the payment screen. Session replay reveals that the keyboard covers the “Subscribe” button on certain Android devices. A small UI fix, informed by usage data, lifts trial-to-paid conversion.

Milestone and “aha moment” analysis

Milestone analysis focuses on key actions that correlate strongly with long-term value. These are the behaviors that separate users who become loyal customers from those who fade away. Common milestones include “Created first project,” “Invited 3 teammates,” “Completed first purchase in under 5 minutes,” or “Generated first report.”

The goal isn’t to guess which milestones matter, it’s to discover them through data. By analyzing users who were still active 180 days after signup and comparing their first-14-day behavior to users who churned, teams identify the actions that predict retention. This turns vague intuition into a specific, measurable activation target.

Example: A marketplace platform might discover that sellers who publish five listings in their first week have 2x higher annual revenue than those who publish fewer. With this insight, the team can refine onboarding: they add progress indicators, in app guidance, and email nudges that push new sellers toward that milestone. The result is more sellers reaching the high-success behavior pattern.

Customer journey and experience analysis

Customer journey analysis examines the entire path from first touch, whether that’s an ad, organic search, or referral, through onboarding, everyday product usage, support interactions, and renewal. It connects marketing and product data to show the complete picture of how customers engage over time.

Modern users hop between desktop, mobile web, and native apps. A customer might research on their phone during a commute, save items to a wishlist, then complete a purchase on desktop that evening. Product analytics should unify these digital interactions so teams see a single, coherent story per user or account rather than fragmented snapshots.

Example: A travel brand analyzing their customer lifecycle might discover that users search flights on mobile, save itineraries, but complete bookings on desktop. Using Fullstory’s Analytics and Mobile App Analytics together, the team sees the cross-device journey and identifies where mobile users drop off, perhaps because the mobile booking flow is too cumbersome. Improving that flow captures bookings that would otherwise be lost.

StoryAI can summarize long, complex sessions and journeys into short narratives that pinpoint friction and emotional moments. Instead of watching dozens of sessions manually, product managers and CX leaders get AI-generated summaries highlighting where things went wrong.

Personalization and activation based on behavior

Behavioral data feeds personalization that actually works. Instead of generic messages based on demographics or email lists, teams can deliver in-product guides, targeted campaigns, and tailored offers based on what users have actually done.

Use cases include nudging users who stalled at onboarding step 2, resurfacing features they tried once but never adopted, or offering discounts to users who repeatedly reach pricing pages but don’t convert. The key is acting on real user actions rather than assumptions about what segments might want.

Example: A B2C subscription service might detect that a user just encountered a payment error and immediately route them to a chat agent with context. A B2B product might see that a trial user just completed a key action and trigger a personalized email celebrating the milestone.

Fullstory Anywhere: Activation uses real-time behavioral signals, like cart abandonment, error encounters, or milestone completion, to trigger relevant experiences in marketing tools, support systems, or in-app messaging.

The goal is making every interaction feel relevant and timely, driven by what users actually do inside your product.

How product analytics impacts the AARRR metrics

The AARRR framework, Acquisition, Activation, Retention, Referral, Revenue, remains a widely used structure for product-led companies. Product analytics touches every stage, providing the data driven decisions that improve performance across the customer lifecycle.

Acquisition: Find the right users

Product analytics goes beyond click-through rates to reveal which acquisition channels bring users who actually activate, retain, and generate revenue. A campaign might drive thousands of signups, but if those users churn within a week, the channel isn’t valuable.

By comparing cohorts acquired via paid search versus organic search, a team might discover that organic users have 30% higher 90-day retention. Marketing then shifts spend toward channels that deliver users who stick around, not just users who sign up.

Connecting behavioral data into a data warehouse via Fullstory Anywhere: Warehouse lets growth and analytics teams join product data with ad and CRM data. This enables full CAC/LTV analysis by channel, showing the true return on marketing spend, as well as a deeper understanding of user retention rate.

Activation: Reach the first “aha” moment

Activation is the moment users clearly experience product value, sending their first invoice, publishing their first post, or booking a trip successfully. Measuring time-to-activation and activation rate by cohort reveals whether users are reaching value quickly enough.

Teams use funnels and replays to streamline onboarding flows that slow activation. A fintech app in might find that identity verification is taking users 3 days to complete. By analyzing where users struggle and simplifying the flow based on behavioral insights, they cut median “first successful transfer” time to 1 day.

Activation metrics directly predict retention. Users who never reach the “aha moment” rarely become long-term customers.

Retention: Keep users coming back

Retention curves, usage frequency, and engagement metrics show whether customers are forming habits around your product. The goal is identifying what separates users who stay from those who leave, then systematically moving more users into the high-retention pattern.

A B2B collaboration tool might discover that teams who set up templates within the first month are significantly more likely to stay for a year. Armed with this insight, they promote templates more heavily during onboarding, increasing the percentage of users who adopt the habit.

Retention work also includes tracking negative signals, errors, failed searches, rage clicks, and systematically removing them. Every point of friction is an opportunity for users to give up.

Referral: Turn customers into advocates

Product analytics can track referral flows, invite links, in-app referrals, sharing features, and correlate them with satisfaction and usage depth. This reveals who your true advocates are and what behaviors predict advocacy.

A subscription service might identify that highly engaged users who use the product daily active users metric consistently are 3x more likely to use referral codes. Rather than blasting referral requests to everyone, they design targeted campaigns around power users who actually convert referrals.

Syncing behavioral cohorts from Fullstory into marketing tools enables smarter referral and advocacy programs that target users most likely to participate and succeed.

Revenue: Optimize monetization and expansion

Product analytics ties directly to revenue by tracking paywalls, pricing pages, upgrade clicks, add-on feature usage, and renewal flows. This reveals what drives users toward paid plans, and what blocks them.

Example: A SaaS company in might discover that users who frequently hit usage limits convert better when shown in-app usage meters and contextual upgrade prompts rather than generic emails. The behavioral signal (hitting limits) triggers the right message at the right time.

Feeding behavioral data into finance and business intelligence tools helps teams forecast revenue more accurately. When you know which features drive upgrades and which friction points block renewals, you can prioritize monetization experiments with confidence.

Product analytics vs. other analytics disciplines

Product analytics, web analytics, marketing analytics, and business intelligence overlap but serve different primary audiences and questions. Understanding the distinctions helps teams choose the right tools and avoid gaps.

Product analytics provides deep behavioral insight inside the product. It’s used mainly by product, UX, engineering, and CX teams to understand user behavior, feature usage, and friction points. The focus is on what happens after users arrive, not how they got there.

Web analytics and marketing analytics focus on pre-signup activity: campaign performance, traffic sources, pageviews, and sessions. Google analytics is a common tool in this category, helping marketers understand which channels drive traffic and conversions. The primary users are growth and marketing teams optimizing acquisition.

Business intelligence covers cross-functional reporting and strategic KPI monitoring. BI tools aggregate data from multiple systems, sales, finance, product, support, to give leadership a holistic view. They’re powerful for executive dashboards but often lack the granular behavioral detail product teams need.

Data management platforms and warehouses form the underlying storage and processing layer. They’re infrastructure rather than end-user analytics tools, enabling teams to join data from multiple sources for advanced analysis.

When should my company invest in product analytics?

Product analytics can benefit your organization any time you wish to improve the user experience. Here are a few reasons you may need to implement product analytics.

When you’re curious about the experiences users have on your site, and concerned with making them better.

When you want to build a product, people like—or better yet, love.

When you want to scale properly, develop your data value chain, increase user retention and conversion rates, and lower customer churn.

When you want to perfect your data storytelling and ensure that you continue to evolve with the market.

How do I choose the right product analytics tool?

The ideal product analytics tool depends on company size, industry, regulatory environment, and internal data maturity. But consistent evaluation criteria apply across contexts:

Data coverage matters first. Can the platform capture web, native mobile apps, and other interfaces like kiosks or embedded experiences? A product analytics system that only covers web leaves blind spots in your digital experience.

Time-to-value separates tools that languish in implementation from those that deliver insights quickly. Look for minimal engineering effort, automatic data capture via a software development kit, and intuitive self-serve analysis for non-technical users.

Privacy and security can’t be afterthoughts. A product analytics platform should offer Private by Default architecture, fine-grained redaction, compliance certifications, and robust governance tools. This protects both users and your organization.

AI capabilities now differentiate platforms. The best product analytics software doesn’t just alert you to problems, it provides contextual summaries, prioritizes opportunities, and enables natural language querying so anyone can ask questions of the data.

Integrations connect product analytics to your broader stack. Warehouse connectors, CRM and CDP sync, support system integrations, and activation hooks into marketing tools ensure behavioral data flows where it’s needed.

What are the best product analytics tools?

Whether you're looking for a general analytics solution or specialized retail and ecommerce analytics, here are some of the top tools to consider:

Fullstory

Fullstory is a behavioral analytics platform that focuses on turning behavioral data into instant, actionable insights. The combination of deep product analytics, session replay, and AI, with privacy built in, helps teams prioritize the highest-impact improvements without drowning in data.

Built on a powerful analytics engine, the behavioral data platform delivers a retroactive view of how people interact with your site or app and connects customer interactions to the metrics that matter.

Google Analytics

Google Analytics is a major player in the analytics space. It offers a low-cost solution to monitor user traffic and general product usage. GA’s main strength is its integration with Google’s offerings and other tools that gather data from your tech stack.

Mixpanel

Mixpanel is a product analytics software, that enables teams to learn from their user data and innovate to create winning products.

Mixpanel offers a variety of solutions to help measure and predict customer usage across unique segmentation needs.

Amplitude

Amplitude is a product analytics tool that helps product teams understand customers while continuously providing insight to ensure proactive retention. Amplitude offers a variety of visuals and data-tracking options that can track high-level KPIs down to granular metrics.

Pendo

Pendo is a growing product analysis and adoption platform that captures quantitative insights, direct customer feedback, and general product metrics across web and mobile applications.

Heap

Heap is a product analytics tool that helps tell the story of user behavior. By tracking user events, product managers can segment and review customer experiences throughout the product with Heap.

Implement a practical product analytics workflow

Rolling out product analytics doesn’t require a massive transformation. Successful teams follow a repeatable workflow that connects data to business goals from day one.

1. Connect analytics to business goals

Analytics projects should start with an objective, not just a dashboard. Specific, measurable goals prevent the common trap of gathering data without a purpose.

Define the win: Instead of "looking at data," aim for "Increase trial-to-paid conversion by 20% in H2."

Map the journey: Connect goals to key user flows like signup, onboarding, and renewal.

Identify success metrics: An e-commerce team might focus on checkout completion, while B2B SaaS teams prioritize time-to-first-value.

2. Design a tracking and governance plan

Even with platforms that offer automatic capture, you need a blueprint. This ensures consistency and prevents "garbage-in, garbage-out" data.

Standardize naming: Decide if it’s

Checkout Startedorstarted_checkoutand stick to it across the board.Define identifiers: Ensure user and account IDs are consistent so you can connect sessions across different devices.

Prioritize privacy: Work with legal and security stakeholders to decide which fields to redact and how long to retain data.

3. Deploy, validate, and iterate

Don't launch everything at once. Roll out in stages to ensure your data is actually reliable before you make big decisions.

Test in staging: Perform known test actions in a staging environment to confirm they appear correctly in your platform.

Start with simple funnels: Build early-win dashboards that answer core questions, like "from homepage to completed signup."

Layer in sophistication: Once the basics are validated, add advanced features like AI summaries and anomaly detection.

4. Move from insight to action

Data without action is just noise. Every insight should lead to a hypothesis, a change, and a follow-up measurement.

Example: If you discover a 50% drop-off at a payment step, don't just note the problem. Watch the sessions to understand why, redesign the page based on those learnings, and then measure the new funnel to confirm the fix worked.

Fullstory helps here by allowing teams to share links to specific sessions or dashboards directly into tools like Jira or Slack. This keeps collaboration fast and keeps the "why" attached to the "how."

5. Establish review cadence and ownership

High-performing teams don't look at data randomly—they make it a habit.

Weekly (Tactical): Review bugs, friction spikes, and urgent UX issues.

Monthly (Strategic): Examine feature adoption, experiment results, and progress toward goals.

Quarterly (Planning): Use analytics to inform the product roadmap and investment decisions.

Assign ownership: Data thrives when it has a "parent." A product lead might own checkout conversion, while an onboarding PM owns the activation rate. When someone is accountable, the data actually gets used.

Mobile product analytics and omnichannel experiences

Mobile apps have become central for industries like retail, banking, travel, and gaming. Their interactions, taps, gestures, offline states, are more complex than web-only products, requiring specialized analytics.

Mobile-specific analytics needs include tracking gestures (swipes, long-press, pinch-zoom) and navigation patterns that don’t exist on web. Frequent app releases and OS changes on iOS and Android mean teams need to identify trends quickly when new versions cause problems. Intermittent connectivity and background states add complexity that web analytics doesn’t address.

Example: A ride-sharing or food delivery app might use mobile analytics to discover that users abandon the payment flow when their connection drops during address confirmation. By identifying this pattern across thousands of sessions, the team can implement better offline handling and recover lost bookings.

Fullstory for Mobile (Mobile App Analytics) captures high-fidelity data in native and cross-platform apps with a privacy-first SDK. Session replay and friction detection are tailored to mobile behaviors, showing exactly where users struggle on small screens.

Turn analytics into a competitive advantage

Organizations that consistently use product analytics develop faster feedback loops and outpace competitors still relying on intuition or sparse metrics. Every feature launch, every bug fix, every optimization is informed by real user behavior, not assumptions.

AI-driven behavioral analytics platforms like Fullstory reduce the burden of manual analysis by automatically highlighting the most impactful issues and opportunities. Instead of sifting through dashboards looking for problems, teams get proactive alerts and prioritized recommendations.

Product analytics isn’t a one-time project you complete and forget. It’s a continuous discipline that underpins product strategy, UX design, and customer experience. The teams that build this muscle, gathering data, identifying patterns, shipping improvements, measuring results, compound their advantage over time.

If your current analytics setup leaves you guessing about what users actually do, or if critical flows go unmonitored, it’s worth auditing your capabilities. The best product analytics platforms combine rich behavioral data, session replay, and AI, all with privacy built in, so teams can move from insight to action faster than ever.

If you've made it this far, check out FullstoryFree, our free plan packed with value.

30,000 sessions monthly

12 months session replay retention

12 months analytics retention